In 2019, Kaunas-based UAB HISTEEL increased its serial production volume and turnover grew by 2.9%. It is one of the leading and most modern metal-processing companies in the Baltic region, producing 850 different articles in production runs ranging in size from 1,000 to 5,000,000 units per year.

The core business of HISTEEL is production of parts by punching and drawing, production of small welded parts and assembly of fittings. The company specialises in the making of prototypes and small series production, when a given article may be produced in a production run ranging in size from several to 1,000 units in a year, as well as mass production, when up to 5,000,000 units of a given article may be produced in a year. Automotive manufacturers and other industrial sectors figure prominently among the company’s customers.

The company’s deputy managing director, Dainius Volskis, emphasises that “2019 was a successful year for our company. Rising volume in serial production and outsourcing of production from Western Europe let the company generate a larger profit and invest in machinery and equipment. Our expanding list of customers gives us the opportunity to plan for continued growth in the next year, despite the situation of our market sector being quite complicated.” HISTEEL’s turnover was 10.5 million euro in 2018 and 10.8 million euro in 2019, that is, an increase of 2.9%.

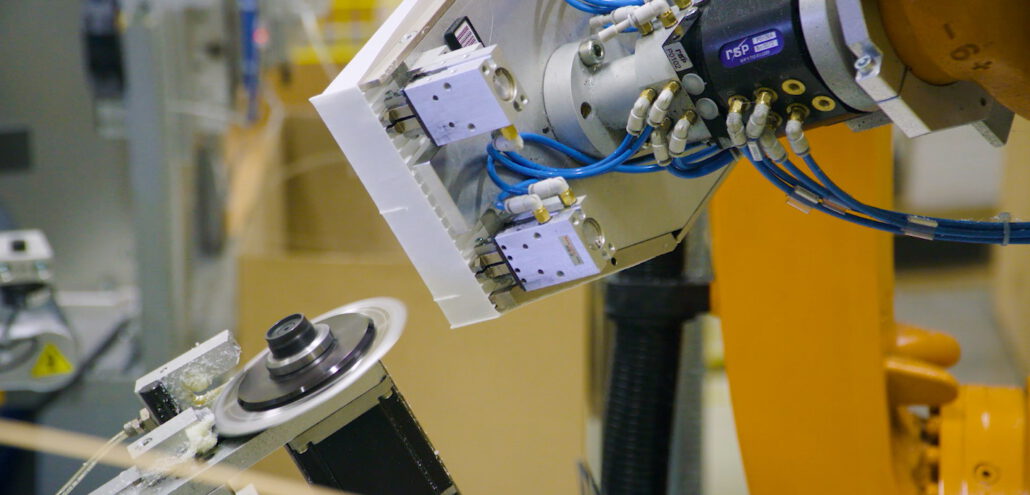

Liudmila Valinčienė, the head of sales, draws attention to the investment in machinery and equipment, thanks to which the production process has become significantly more efficient. “Last year, companies across our sector in Europe experienced decreasing sales volume, but that encouraged us to look for alternative solutions,” she says. HISTEEL constantly pursues innovations and has been able to find long-term sales partners.

At present, product assortment includes 850 different articles. One of the company’s main advantages is the fact that a customer can find everything it needs under one roof:

- From design to technical calculation and tool production in-house.

- Coordinated and effective processes using optimal solution methods.

- HISTEEL stays with the customer throughout the entire process: from the initial idea right through to serial production.

The company exports most of its production to customers in Germany, France, Austria, Hungary and the Baltic region. Only about 12% of production stays in Lithuania.

Liudmila Valinčienė, the head of sales, says that the company invested heavily in 2019 in employee training, to develop specialised skills. Employees with exceptional competencies contribute greatly to improving efficient production processes and increasing sales.

She emphasises that in recent years, the company has been audited by several foreign companies prior to possibly beginning the production of certain articles. According to her, the results of these audits have been quite successful, so in the future the company expects some significant orders.